The European Commission’s anti-subsidy inquiry into Chinese electric vehicles has been described as one of the most consequential of its kind.

China-made battery electric vehicles (BEVs) will soon be subject to import tariffs when they are brought into the European Union’s borderless market, where demand for these environmentally-friendly products has soared in recent years.

The European Commission announced on Wednesday the first provisional decision under its anti-subsidy inquiry for BEVs assembled in China, split by brands:

- BYD: 17.4%

- Geely: 20%

- SAIC: 38.1%

- Other BEV producers in China that cooperated in the investigation but have not been individually sampled: 21%

- Other BEV producers in China that did not cooperate: 38.1%

The level will come on top of the existing 10% import tariff and defies industry expectations of 20%, suggesting the Commission’s findings are quite damaging.

The measures will be introduced in early July if China fails to offer convincing, effective solutions to remedy its unfair trade practices. Beijing has long refused to engage with Western allies to address frictions and often denies the source of the problem itself.

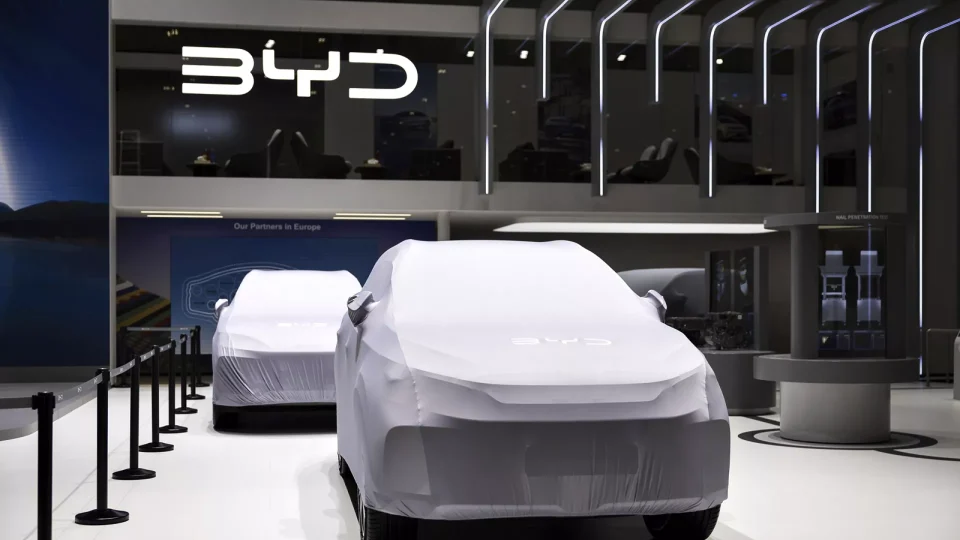

In practice, the decision means both Chinese and Western brands that operate plants in the Asian country will be affected by the increase, albeit not equally. The prime company under scrutiny was Shenzhen-based BYD, which aims to conquer 5% of the bloc’s BEV market. Meanwhile, Tesla, a leading actor in the field, filed a “substantiated request” and may be granted its tailor-made rate later this year.

“This is based on clear evidence of our extensive investigation and in full respect of WTO [World Trade Organisation] rules. We will now engage with Chinese authorities and all parties with a view to finalising this investigation,” said Valdis Dombrovskis, the Commission’s Executive Vice-President in charge of trade.

“Our goal is to restore the level-playing field and ensure that the European market remains open to electric vehicles producers from China, provided that they play by globally agreed trade rules,” he added.

A 7.3% market share

Brussels is deeply worried that, due to Beijing’s generous injections of subsidies, European firms will be unable to compete with Chinese producers and will be eventually pushed out of the increasingly lucrative sector, as happened with solar panels.

Sales of China-made BEVs have rapidly grown: from 57,000 new units sold in 2020 to more than 437,000 in 2023, according to Eurostat, including models from Western firms like BMW, Renault and Tesla. Over the same period, the value of these transactions rose from €631 million to €9.66 billion.

A study by Transport and Environment (T&E) indicates the market share of Chinese brands in the EU’s BEV market ballooned from 0.4% in 2019 to 7.9% in 2023 and could jump past 20% by 2027 if the trend continues unabated.

The Commission has already established the existence of multi-pronged state aid in China, which takes the form of grants, cheap loans, state-backed credits, tax rebates, VAT exemptions and discounted prices of goods and services, among others.

The point of the investigation, formally launched in October after Ursula von der Leyen’s State of the Union address, is to determine whether this assistance could, sometime in the future, cause “injury” to the EU industry. In other words, unsustainable losses of sales volumes, profit margins and market share.

The provisional decision announced on Wednesday indicates the Commission believes the threat is real and radical measures are needed to avert the worst.

The move is all but certain to unleash Beijing’s fury. The country has said it would not “sit back and watch” as levies are introduced, pointing the finger at the EU’s agriculture and aviation sectors as tit-for-tat targets.

Mind the gap

The additional tariffs are designed to make China-made BEVs more expensive to sell in the bloc and bring their end prices closer to their European rivals with the ultimate goal of ensuring fair competition.

How much will the gap close remains to be seen.

Chinese firms sell their BEVs in Europe at a much higher price than they do back home, a phenomenon the Rhodium Group has described as the “EU premium.” This leaves them ample space to accommodate tariffs, which could be absorbed internally without necessarily leading to higher consumer prices.

Besides state aid, Chinese producers also benefit from low labour and energy costs, easy access to raw materials and a robust ecosystem to churn out batteries. Additionally, the Chinese economy is going through a slowdown fuelled by sluggish domestic demand, which has made companies rely even more on exports abroad.

“Duties in the 40-50% range – arguably even higher for vertically integrated manufacturers like BYD – would probably be necessary to make the European market unattractive for Chinese EV exporters,” the Rhodium Group said in an April report.

Still, slapping that kind of eye-popping tariff would be risky for Brussels, as member states remain divided on how hard the bloc should go against Beijing’s unfair practices.

In November, the provisional measures will be put to a vote among member states to make them permanent. Here, a qualified majority will be needed to quash the levies, a threshold that is rarely but certainly not impossible to reach.

All eyes will be on Germany, a world-leading car exporter that has, over decades, expanded its presence in China and increased its dependency on the market.

The German Association of the Automotive Industry (VDA), backed by the likes of BMW, Mercedes-Benz and Volkswagen, has already made clear its opposition to additional tariffs, arguing these will not be “suitable for strengthening the competitiveness of the European automotive industry” and could trigger a “major trade conflict.”

Industry pressure, coupled with divisions inside Chancellor Olaf Scholz’s three-party coalition, indicates Berlin will vote down the tariffs in November.

Hungary, which has attracted investments from BYD, is also considered a guaranteed opponent. Other liberal-minded countries, like Sweden and Ireland, have expressed reservations but without explicitly coming against the duties.

On the other side of the debate, France, whose car-making companies are less exposed to the Chinese market, is widely considered the probe’s main backer. Italy has recently voiced support for the initiative and called for the EU to follow America’s lead, where President Joe Biden announced 100% tariffs on China-made BEVs.