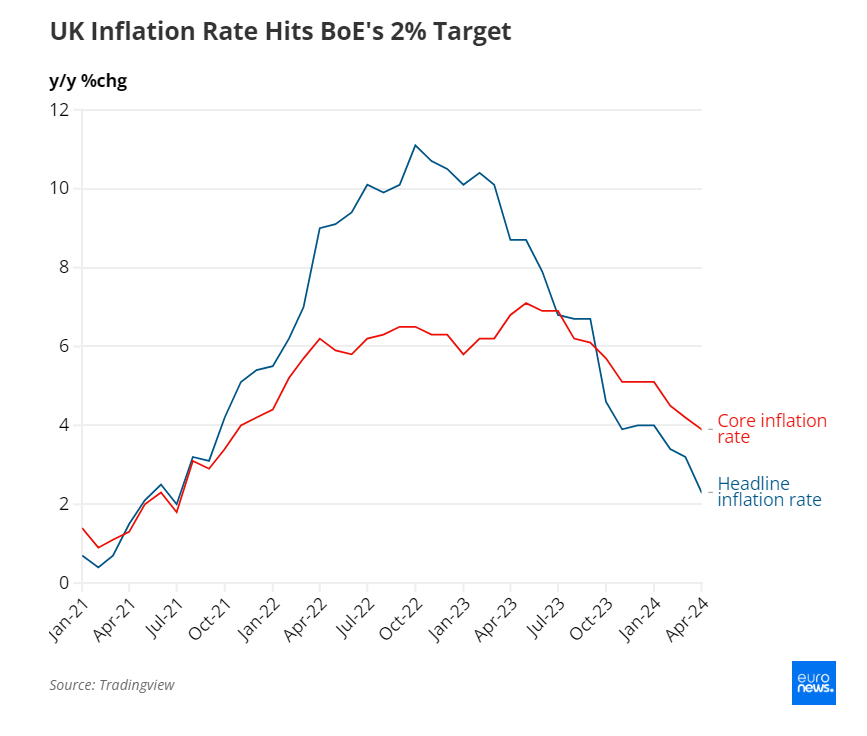

The United Kingdom’s overall inflation rate fell to 2% year-on-year in May, hitting the Bank of England’s target for the first time since July 2021, just ahead of the bank’s June meeting.

This marks the lowest annual change in the consumer price index since July 2021, aligning with analysts’ forecasts. On a monthly basis, inflation increased by 0.3% in May 2024, consistent with April 2024 but slightly below economist expectations.

The UK’s CPI inflation rate was lower than France (2.6%), Germany (2.8%), and the EU average (2.7%), and matched the US (2.0%) in the 12 months to May 2024.

The decline in annual inflation rates in May 2024 was driven by reductions in food and non-alcoholic beverages, recreation and culture, and furniture and household goods. However, transport and communication provided the largest upward pressures.

Excluding energy, food, alcohol, and tobacco, core inflation rose by 3.5% in the 12 months to May 2024, down from 3.9% in April, meeting expectations. This represents the lowest core inflation rate since October 2021. On a monthly basis, core inflation increased by 0.5%, slowing from 0.8% in April.

Services inflation recorded a 5.7% year-over-year rise and a 0.6% month-over-month increase, slightly down from the previous 5.9% and 0.8% respectively, but overall a little higher than expected.

Simultaneously, the Office for National Statistics reported a 1.7% year-over-year increase in annual producer prices in May 2024, marking the highest rate in a year.